If your application for a payment plan is accepted by the IRS and you owe more than a certain amount, you’ll have to set up a Direct Debit Installment Agreement (DDIA) to have monthly payments automatically withdrawn from your checking account.

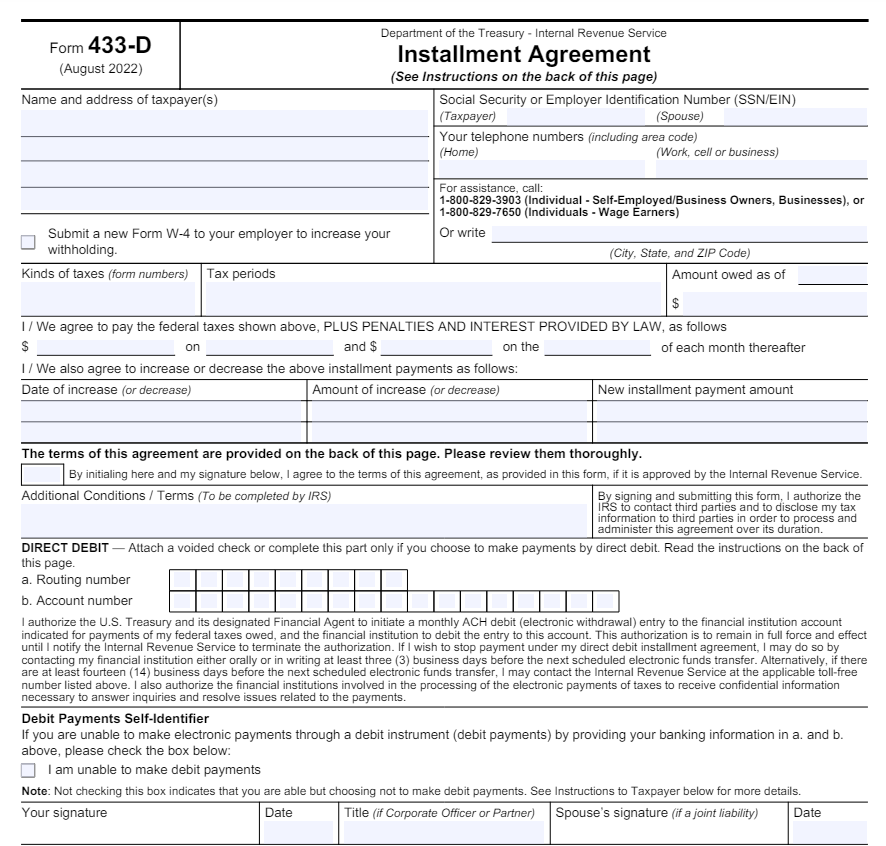

To do that, you’ll need to fill out IRS Form 433-D, Installment Agreement.

What is Form 433-D?

433-D is a one page form the IRS uses to collect all of the information they need to set up a new Direct Debit Installment Agreement, or alter an existing one.

Keep in mind that this is not the form you use to apply for a payment plan in the first place. You must do that by submitting an application through the IRS’s Online Payment Agreement tool, or by submitting Form 9465, Installment Agreement Request.

Many payment plans allow you to pay any way you can: via the Electronic Federal Tax Payment System (EFTPS), by check, money order, debit card or even credit card. If you set up a long-term payment plan and you owe above a certain amount, however, you’ll have to set up direct debit payments to the IRS by using Form 433-D.

What are “short-term” and “long-term” payment plans?

If you can’t pay your taxes on time, or you fail to file a tax return at all, the IRS might assess penalties and interest, offset your future refunds, and also make it difficult for you to obtain loans in the future.

A payment plan is an arrangement with the IRS that allows you to pay your taxes over a longer period of time and avoid further interest and penalties.

A short-term payment plan involves paying your balance in 180 days or less. If you need more time than that, you’ll need to set up a long-term payment plan, also known as an “installment agreement.”

How do I set up a payment plan?

A payment plan isn’t something you can just set up by yourself: you’ll have to apply for one through the IRS’s Online Payment Agreement tool, over the phone, or by submitting Form 9465, Installment Agreement Request.

You’ll usually hear back from the IRS within 30 days of submitting your request, however if the payment plan is for tax due on a return filed after March 31st it might take longer.

If the IRS accepts your request, they’ll send you a notice detailing how much you’ll have to pay every month, as well as a user fee.

What are user fees, and why do I have to pay them?

The Office of Management and Budget requires that the IRS charge user fees for setting up payment plans and other services. These fees vary depending on how you applied for your payment plan in the first place, and how you end up paying.

If you apply for a payment plan online, the fee is:

- $31, if you end up paying by direct debit

- $130, if you pay by check, money order, credit card or debit card

If you apply for a payment plan any other way–by phone, mail, or in-person–the fee is:

- $107 to set up direct debit

- $225 for the other payment types

If you’re a low-income taxpayer, you might qualify to have these fees reduced or waived. If the IRS doesn’t automatically classify you this way but you believe you might qualify for Low Income Taxpayer Status anyway, fill out and submit Form 13844 to the following address:

Internal Revenue Service

PO Box 219236, Stop 5050

Kansas City, MO 64121-9236

What is a Direct Debit Installment Agreement?

A Direct Debit Installment Agreement allows the IRS to withdraw a certain amount from your checking account every month to pay down your balance. To set one up with the IRS, you’ll have to complete and file Form 433-D, Installment Agreement.

If you’re an individual, sole proprietor or independent contractor and you applied online for your payment plan, and your total balance is over $25,000, or you’re a business and your balance is over $10,000, you’ll have to pay your balance by direct debit.

How to fill out Form 433-D

Before filling out Form 433-D, you’ll need to have the following information on hand:

- Your Social Security or Employer Identification Number (SSN/EIN)

- Your contact information

- The information included in your payment plan notice, including what kinds of taxes you owe, the period you owe them for, and how much you owe

- Your bank routing number and bank account number, or a voided check

- Information about any recent changes to your payment plan

Once you’ve got that, you’ll need Form 433-D itself, which is one page long and looks like this:

The form begins by asking you for contact and social security information, then your payment plan details and information about any changes to your existing payment plan, followed by your banking information.

When filling out line a. (Routing number) remember that the first two digits should be 01 through 12 or 21 through 32. Make sure to use the actual routing number and not an internal routing number from a deposit slip.

When filling in line b. (Account number) include hyphens but avoid using spaces and special symbols, and leave any unused boxes empty.

Where do I mail Form 433-D, and what’s the deadline for filing it?

The notice you receive from the IRS about your payment plan application will tell you when you have to set up direct debit, when your payments are due, and also which address you’ll have to mail 433-D to, which will vary depending on your address.

How do I know my payment went through?

You can check your balance and payment history by logging into your online account at irs.gov/payments. Remember that it could take up to three weeks for a recent payment to show up in your account.